PayQin

Description of PayQin

PayQin is an e-wallet application designed to facilitate financial transactions in emerging countries. It serves a dual purpose by offering users a convenient way to manage their finances while also providing merchant tools for local small and medium enterprises (SMEs). Available for the Android platform, users can download PayQin to access its extensive features for both personal and business transactions.

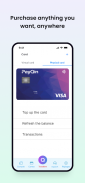

The app includes a built-in virtual and physical debit card, allowing users to make purchases online across various global retailers. This feature is particularly beneficial for those without traditional bank accounts, enabling them to participate in e-commerce efficiently. The debit card can be linked to the PayQin wallet, making it easy to manage funds and transactions from a single interface.

Users can recharge their PayQin debit cards using mobile money, which is a convenient option in many emerging markets where traditional banking services may not be readily accessible. This functionality streamlines the process of adding funds to the wallet, ensuring that users have continuous access to their money for both everyday purchases and online shopping.

PayQin supports instant money transfers between users in different countries. This feature is designed to make cross-border transactions straightforward and efficient. Users can send and receive funds quickly, which is especially useful for expatriates or individuals who need to support family members in other nations. The app aims to reduce the time and costs typically associated with international money transfers.

Additionally, PayQin provides merchant tools that empower local SMEs to accept payments both online and offline. By equipping businesses with the necessary tools to process transactions securely, PayQin helps to foster economic growth within communities. Merchants can register and set up their accounts easily, enabling them to reach a wider customer base through digital payment options.

The integration of various payment methods within the app enhances user experience. Customers can use their PayQin wallet to pay at participating merchants without the need for cash, promoting a cashless economy. This shift toward digital payments aligns with global trends, making it easier for businesses to manage sales and for consumers to track their spending.

Security is a critical aspect of any financial application, and PayQin addresses this concern by implementing robust security measures. The app employs encryption and secure protocols to protect users' financial information during transactions. This focus on security helps build trust among users who may be cautious about adopting digital payment solutions.

PayQin’s user interface is designed to be intuitive and user-friendly, allowing individuals of varying technical expertise to navigate the app with ease. The layout presents essential features clearly, ensuring that users can quickly access the functionalities they need. This accessibility is crucial for encouraging adoption, particularly in regions where users may be unfamiliar with digital financial services.

For users interested in managing their finances, the app offers tools for tracking spending and budgeting. These features enable individuals to gain insights into their financial habits, helping them make informed decisions about their spending. By promoting financial literacy, PayQin aims to empower users to take control of their financial futures.

In addition to individual financial management, PayQin facilitates business growth by providing analytics tools for merchants. These tools help businesses understand customer behavior and sales trends, enabling them to make strategic decisions based on data. By offering insights into performance, PayQin supports SMEs in optimizing their operations.

The app also includes customer support features, allowing users to seek assistance when needed. This support is essential for addressing any issues that may arise during transactions or account management. An effective support system contributes to a positive user experience, encouraging continued engagement with the app.

PayQin's commitment to serving emerging markets is evident in its design and functionality. The app not only simplifies financial transactions for individuals but also supports local businesses in adapting to the digital economy. By bridging the gap between traditional finance and modern digital solutions, PayQin plays a significant role in transforming how people and businesses manage money.

With its comprehensive range of features, PayQin positions itself as a valuable tool for both consumers and merchants in emerging economies. Users can easily manage their finances, make purchases, and transfer money across borders, all while benefiting from a secure and user-friendly platform. The app’s focus on empowering local SMEs further enhances its significance in fostering economic development.

PayQin stands out as a versatile financial solution that accommodates the needs of users in diverse environments. Its ability to integrate various financial services into a single app reflects the changing landscape of payments and commerce in emerging markets. By downloading PayQin, users can take advantage of these features to enhance their financial management and engage with the evolving digital economy.